5 things to know about EITC and the American Rescue Plan Act

Research has found that the EITC increases participation in the labor force, particularly among single mothers, and reduces poverty. But its impacts are generally restricted to families with children. An expanded EITC for workers without qualifying children might similarly encourage work and reduce poverty among these individuals.

Leading up to April 15, what normally would be Tax Day, there has been a lot of chatter about the American Rescue Plan Act’s (ARPA) expansion of the federal Earned Income Tax Credit. Here are five things to know about ARPA:

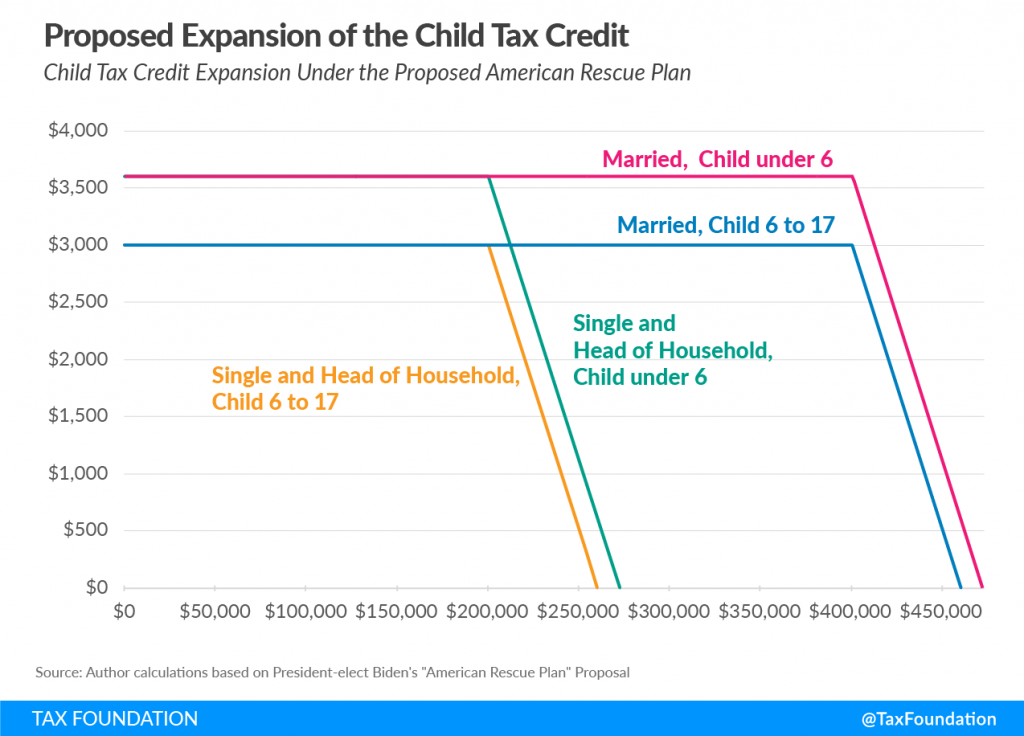

- Temporarily expands the Earned Income Tax Credit (EITC) available to families not raising children in the home. This change is intended to complement a set of changes to the Child Tax Credit, which make the full credit available to 27 million children whose families haven’t qualified for the full credit because their parents lack earnings or have earnings that are too low. Together, the two provisions seek to support low wage households with and without children.

- Raises the credit percentage from 7.65% to 15.30% and increases the income at which the maximum credit amount is reached to $9,820. As a result, the maximum credit increases from $543 to $1,502.

- Raises the income range over which the credit is phased out from $8,800-$15,980 to $11,610-$21,000 (est.). As a result, more individuals and families will be eligible for the credit.

- Expands the age range of eligible workers without children to include younger adults aged 19-24 (excluding students under 24 who are attending school at least part time), as well as people aged 65 and over.

- Changes expire at the end of the 2021 tax year unless Congress extends them or makes them permanent.

Only about 80% of eligible individuals nationally claim the EITC. That means 5-6.5 million families are not taking advantage of the credit. People living in rural areas are less likely to claim the credit than those in urban areas. Given the potential role of the EITC to local economies, the ncIMPACT Initiative at the UNC School of Government is working on a Rural EITC Uptake Project with Rural Forward NC, Together Transforming Lives, and the UNC School of Social Work’s Jordan Institute for Families. This ongoing project is taking place in Beaufort, Edgecombe, Halifax, McDowell, Nash, Robeson, and Rockingham counties, and is working to both understand the number of eligible individuals claiming the credit and reasons the credit may go unclaimed. We have been conducting research with these communities on motivations and patterns of uptake. The reasons that have surfaced in our focus groups are varied. They include:

- Lack of awareness among low-wage workers about the existence of the credit.

- Low-wage workers who may not be aware they are eligible for the credit because they do not owe taxes or are not required to file.

- Lack of tax preparer awareness of how the credit works.

- Language or cultural barriers.

- Low trust of government.

For more information on our project, please see our project home page and earlier blog on the EITC.

The project’s interdisciplinary team includes co-principal investigators, Sarah Verbiest with the Jordan Institute for Families and Anita Brown-Graham with UNC School of Government and ncIMPACT Initiative; co-investigators Calvin Allen with Rural Forward NC; Danny Ellis with Together Transforming Lives, Inc., Paul Lanier, with the UNC School of Social Work, and Whitney Afonso with the UNC School of Government. The project team includes Katherine Bryant and Phillip Sheldon.