Why is EITC Important?

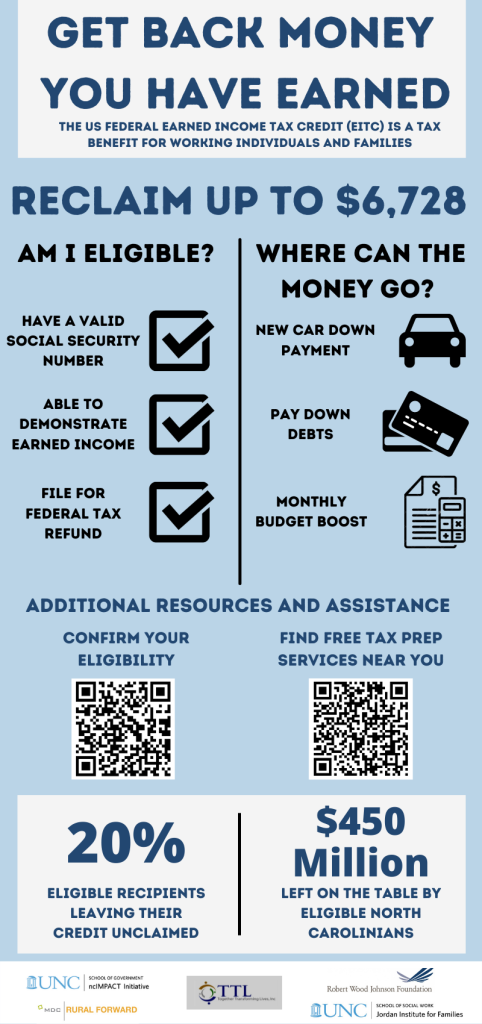

The Earned Income Tax Credit (EITC) is the federal government’s largest benefit for workers. For people who have earned income from working for someone or running a business or farm, it’s money that positively impacts change in their life, family and community.

We know four out of five eligible taxpayers receive their EITC. This means millions of taxpayers are putting EITC dollars to work for them. But missing that one in five means millions of people are not taking advantage of this valuable credit they earned. Almost a third of those who qualify for EITC will do so for the first time this year due to changes in their marital, parental, or financial status. That’s why reaching out through programs like this partnership with the ncIMPACT Initiative, The Jordan Institute for Families, and the UNC School of Social Work, Foundation for Health Leadership and Innovation is so important.

EITC is one of the Largest Antipoverty Programs

- Nationwide, as of December 2019, about 25 million taxpayers received about $63 billion in EITC. The average amount of EITC received nationwide was $2,476.1

- Approximately four of five people eligible for the EITC claim it.2

- EITC and the child tax credit (CTC), greatly reduce poverty for working families. These working family credits lifted an estimated 8.9 million people out of poverty in 2017, including 4.8 million or more than half of them children.3

- The cost of administering the EITC program ratio to claims paid is less than one percent.4

1Source: Calendar Full Year Report, December 2019.

2 Source: The national EITC participation rate is 78% (TY2016), estimated in cooperation with the Census Bureau. The TY2016 estimates based on the Current Population Survey (CPS) is 78%, while the TY2016 estimate based on the American Community Survey (ACS) is 78.6%.

3Source: Center on Budget and Policy Priorities, Policy Basics: The Earned Income Tax Credit, June 21, 2019.

4Source: House Committee on Ways and Means, Subcommittee on Oversight, Hearing on Improper Payments in the Administration of Refundable Credits, May 25, 2011.

Basic EITC Eligibility Requirements

Determining eligibility for EITC is complicated. You must make over 20 separate determinations. Basic qualifiers are outlined here. Refer to the EITC Home Page on irs.gov for more detailed information on who qualifies for EITC.

Who is missing out?

The IRS estimates that four out of five workers claim the EITC they earned. We want to help reach the potentially qualifying workers who miss out on thousands of EITC dollars every year. Our project is designed to help educate them about the tax credit and motivate them to join the four out of five who file and claim it. This includes workers who are:

- living in rural areas,

- self-employed,

- receiving certain disability pensions or have children with disabilities,

- without a qualifying child,

- not proficient in English,

- grandparents raising their grandchildren, or

- recently divorced, unemployed, or experienced other changes to their marital, financial or parental status

Joint Research Study

The “Get Back Money You Have Earned” infographic was created by community teams to help spread awareness to North Carolinians across the state on the Earned Income Tax Credit as part of a joint research study funded by the Robert Wood Johnson Foundation. Please feel free to share this infographic widely with members of your community. This work was completed by an interdisciplinary team that included members from the Jordan Institute for Families at the UNC School of Social Work, UNC School of Government, the ncIMPACT Initiative, Rural Forward NC, and Together Transforming Lives Inc. The study focused on the following counties: McDowell, Rockingham, Robeson, Beaufort, Nash, Halifax and Edgecombe. This research involved focus group interviews with 115 rural North Carolina leaders about their experiences in promoting the EITC in their communities and the input of state and local community research teams.

Best Practices for Increasing EITC Uptake

Best Practice 1: Well-timed marketing efforts that are tailored, target, and inclusive can ensure tax-filers have relevant information when they most need it and can better meet people where they are.

Summary: One of the most prominent best practices for increasing EITC uptake is proper marketing/outreach to increase public awareness of tax credit. Generally, a combined strategy of automated phone calls and a mailer campaign has been proven to be successful whereas targeted online strategies did not produce a significant increase in filers. Additionally, targeting information about the EITC to certain groups has been shown to increase uptake. Research indicates framing the EITC as something owed to recipients and it is already their money which they need to claim is the most effective general framing. Strategies targeting employees at specific places of employment, rather than a broad notification of the EITC, result in higher uptake among EITC- eligible employees. One of the largest barriers to uptake currently identified is a lack of English proficiency. Some studies have indicated that having material translated into Spanish increase participation among eligible Hispanics, but this is the extent of the research into translation.

Best Practice 2: Outreach should be systematic and annual and pair education with actionable steps.

Summary: Building off the previous recommendation, multiple reminders or the use of multiple different messaging strategies seems to prove more effective at increasing the take-up of the ETIC. Using multiple approaches at once and repeating and expanding those outreach efforts is necessary for having a more meaningful increase in EITC filings. Governments and non-profits that send out informational mailers about the potential benefits of tax filing with the provision of a free filing service saw a moderate increase in the number of filers. Many of these new filers were also eligible for and claimed the EITC. IRS mailers provided information about the EITC and how much money was being left on the table by non-recipients. The results indicated that a full rollout of mailers to all EITC-eligible non-recipients could increase uptake by 3% (reducing non-uptake from 25% of all eligible to 22%).

Best Practice 3: Leveraging trusted relationships can expand potential sources of information.

Summary: Spreading information about the EITC through “trusted relationships” can increase participation as well. Multiple studies have confirmed the IRS as a trusted institution and mailers/information coming from them (as seen in the above paragraph) can increase EITC uptake. Canvassing and word-of-mouth tend to be the most successful methods by which to spread the word about free tax preparation services being offered. Other examples include local municipalities placing reminders about the EITC and its benefits on utility bills to remind residents about its availability. Other, more informal relationships (faith leaders and local non-profits) have not yet been shown to be as effective.

Best Practice 4: Volunteer Income Tax Assistance (VITA) sites should recruit multilingual and community leaders as volunteer tax preparers.

Summary: The availability of free tax preparation services has been shown to increase both tax filing rates and EITC uptake. Sponsorship of the federal Volunteer Income Tax Assistance Program is shown to be a proven way to increase uptake of the EITC. Reminding eligible recipients about their eligibility is the first step in increasing uptake. Often, recipients then went to a locally available, free tax preparation service to file for the EITC. Otherwise, they were not as likely to file for EITC benefits. Having translation services available can increase the uptake by Hispanic populations, a community shown to be less likely to uptake the EITC.

Best Practice 5: Consider novel ways to reach newly eligible EITC populations and educate them on expanded benefits.

Summary: Lastly, studies looking at interventions that seek to target newly eligible populations recommend promoting the EITC as an “asset-building” tool was most successful in increasing uptake. A “weak financial status” among newly eligible households made them interested in learning about ways they could increase assets, such as the EITC. Most were not aware of the EITC as an asset-building tool, further increasing the number of new filers who could be reached via this method. As with other interventions with previously eligible populations, sending follow-up reminders, even just one, increased EITC uptake by 14%. Best practices for these reminders include better, clearer information and simpler design choices.

More about EITC