Economy

Economy

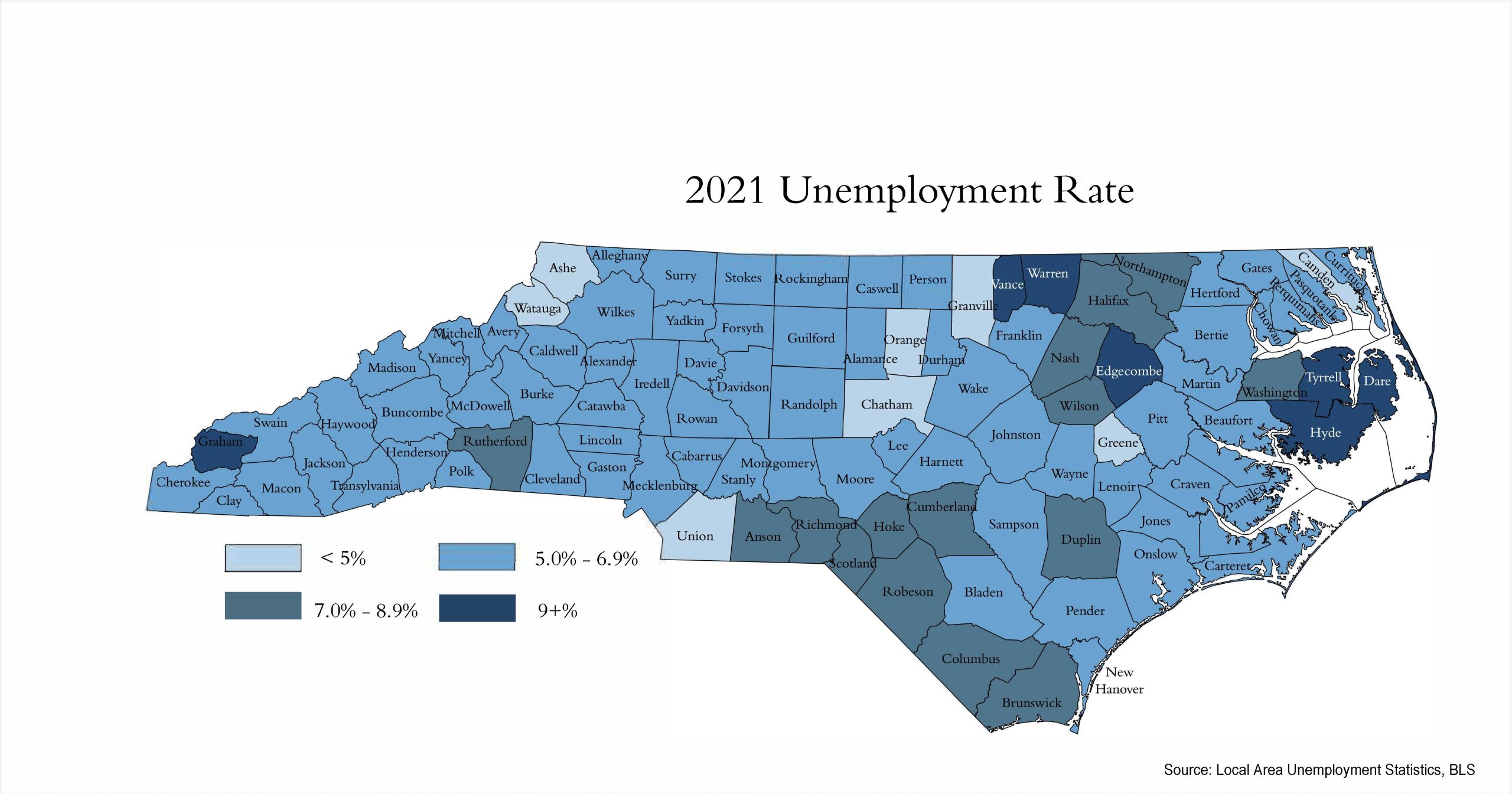

North Carolina seeks to build and sustain vibrant, healthy, resilient, and connected communities that produce, attract, and retain firms, workers, and entrepreneurs. Place-based assets are the building blocks of economic development and include the physical infrastructure necessary to expand broadband access, enhance regional transportation and transit options, and increase the supply of workforce housing. Local strategies include placemaking, downtown revitalization, product development, and disaster resilience and recovery efforts. At the same time, the hollowing out of middle-income jobs nationally and resulting economic insecurity threaten the state’s economy by failing to create opportunities for all North Carolinians to contribute creativity, productivity, and innovation.

The ncIMPACT Initiative provides data and analysis to assist local and state policymakers in making decisions intended to strengthen the state’s economy. For example, we completed a project for the Kate B. Reynolds Charitable Trust to determine the root causes that contribute to Forsyth County’s persistent poverty rates and other related socioeconomic conditions. We recommended ways their local funding strategy could address these causes through an inclusive economy strategy. We also collaborated with the UNC Center for Urban & Regional Studies to staff the North Carolina Comprehensive Strategic Economic Development Plan for the NC Department of Commerce.

Resources

- Broadband’s Impact on Economic Development: A Lack of Access to Social Capital

- ncIMPACT Town Hall: Constructing North Carolina’s Creative Placemaking Economy, Premieres Thursday, January 30 at 7pm

- Rural Transportation Challenges- Hertford and Bertie Counties

- ncIMPACT Top Tweets on Inclusive Economy

- Sticky Floors Impede Economic Mobility in North Carolina

- Best Practices in Place-Based Grantmaking